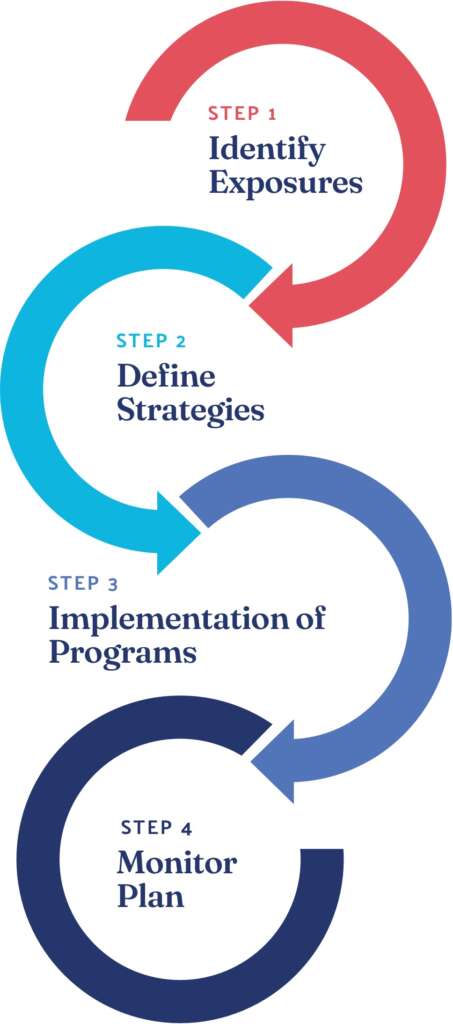

Our 4 Step approach to Risk Management is the key to managing your insurance program and minimizing your losses so your business can thrive in today’s market.

STEP 1

Identify Exposures

During the crucial onboarding phase, HMS will invest the time to understand every facet of your business in order to help you and your team identify the risks which face your organization. By evaluating the effectiveness of risk management programs, practices, and resources under “day-to-day” conditions, we assure that your assets receive the right type of protection.

Tour of Facilities

Employee Interviews

Loss Control Survey Assessment

Claims/Reserve Analysis Procedures

Policy Review

Experience Modification Review

Job Safety Analysis

Employment Practices

Emergency Planning

Accident Analysis & Injury Causation

Contract Reviews

Cyber

STEP 2

Define Strategies

Once HMS has developed a thorough understanding of your business, including your industry, corporate culture, and operating procedures, we are ready to move beyond insurance; exploring a spectrum of proven alternative strategies to minimize risk than can reduce insurance costs.

Risk Minimization

Contractual Risk Transfer

Risk Avoidance

Retention of Risk

Policies/Procedures and Controls Insurance

STEP 3

Implementation of Programs

During the implementation process we put in place specially tailored programs and strategies designed to protect your assets while reducing insurance costs. A Strong belief in HMS’ process motivates underwriters to offer lower insurance costs on your behalf.

Action Plans

Tailored Programs

Marketing

Insurance

Loss Control/Safety

Claims Management

Results Oriented Strategies

STEP 4

Ongoing Monitoring & Adjustment

You and your business are dynamic – what may work for you today might not work as well tomorrow. For this reason, HMS will continue to monitor and adjust your risk management programs to ensure a perfect fit as your business evolves and changes. This is where HMS’ more comprehensive understanding of your business enables us to precisely tailor your protection to fit the unique needs of your business.

Risk Assessments

Claims Reviews

Stewardship Reports

Risk Management Service Plans

Pre-renewal Strategy Sessions

HR/Employment Practices Audits